The Inflation Reduction Act, signed into law in 2022, is full of twists and turns to ensure organizations are eligible for clean energy tax credits.

Two years ago, the Inflation Reduction Act sped through Congress and was signed into law by President Joe Biden on Aug. 16, 2022, ushering in a clean-energy development boom. The IRA contained numerous clean energy deployment tax credits and bonuses designed to incentivize a robust domestic marketplace, along with $12 billion in credit subsidies and further $100 billion in grants and other programs.

As of June, funding from the IRA has led to more than $361 billion in investments and the creation of over 312,000 jobs from 585 new clean energy projects. And the Biden administration is touting its law’s successes.

“We’ve made incredible progress implementing the IRA,” said senior White House climate advisor John Podesta on an Aug. 7 call with reporters. “The IRA is government-enabled, but private sector led.”

And the private sector has plenty to do to prepare for the next phase of the IRA tax credits in 2025.

Tech neutral takes over

Beginning on Jan. 1, 2025, the Investment Tax Credit (ITC) and Production Tax Credit (PTC) mechanisms will officially transition over to “tech neutral” credits. The ITC and PTC enabled businesses to receive specific cost deductions on solar or wind-powered electricity generation, with the amount dependent on the tech itself.

Moving forward, the tech neutral credits remove the need for businesses to specify the technology used to produce clean energy. Instead, the tech neutral credits streamline the process, allowing companies to receive tax credits for renewable energy production from not only solar and wind, but also nuclear, geothermal, hydropower, and previously stored energy.

Moving forward, so long as the non-combustion energy source has zero emissions and commences construction before 2033, it is eligible for the tech neutral credit through 2032 or until power sector emissions fall 25% below 2022 levels.

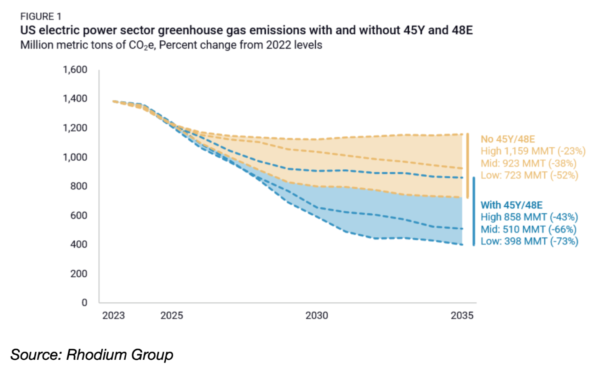

A recent report from the Rhodium Group projected that the impact of this new tech-neutral credit could lead to as much as a 73% drop in emissions from 2022 levels by 2035, compared to the max of a 53% drop without the credit in place.

How IRA tax credits will lower emissions

Source: Rhodium Group

The twists and turns of elective pay credits

The IRA introduced the practice of “elective pay,” more commonly known as direct pay. This service allows entities to receive a payment equal to the value of the applicable tax credit for building clean energy projects. The federal government provides direct cash payments to the organizations in the amount of the energy tax credit. Applicable credits can be found here.

Many entities are using the remainder of 2024 to ensure their eligibility for direct pay, according to Joel Laubenstein, a principal consultant at Baker Tilly.

The clean energy boom the IRA engendered is certain to be one of the lasting legacies of Joe Biden’s one-term presidency.

Non-profit clients including municipalities, municipal owned utilities, universities, K-12 schools and health care organizations have specific provisions that must be met to receive direct pay eligibility, explained Laubenstein. One such requirement is the domestic content bonus, which increases the worth of individual IRA tax credits by 10%.

“That’s the requirements for projects that are being developed by those elective pay entities to use a certain percentage of domestically manufactured components in their projects,” said Laubenstein.

Other corporations can apply the domestic content bonus just as it is designed to be used — as an additional amount of money on top of the clean energy credits. But that rule doesn’t hold fast for non-profits in the future.

“Should [elective pay entities] not meet the domestic content requirement after 2026, there is a cliff whereby…they are no longer eligible for direct pay,” said Laubenstein, concluding that he’s urging his clients to ensure domestic content for their projects as quickly as they can.

There’s plenty of future opportunities ahead for the private sector. And regardless of who wins the November presidential election, the clean energy boom the IRA engendered is certain to be one of the lasting legacies of Joe Biden’s one-term presidency.

This article originally appeared on Trellis (formerly GreenBiz) as part of our partnership with GreenBiz Group, a media and events company that accelerates the just transition to a clean economy.